Income Tax and VAT amendments proposed by the Budget Implementation Bill

- Matthew Aquilina Colombo

- Oct 28, 2025

- 3 min read

Bill 155 of 2025, the Budget Act Implementation Bill published on the 28th October 2025, introduces the following changes to the Income Tax Act and the VAT Act:

Income Tax Act

The proposed changes to the Income Tax Act relate only to the changes in the personal tax rates, with a twist.

Married tax rates

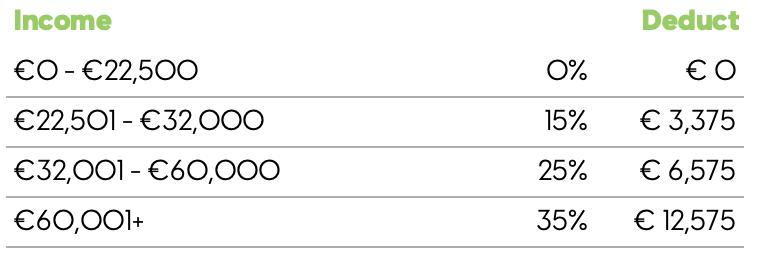

Contrary to what was indicated and understood in the budget speech, the bill suggests that the married rates are being updated to the following (even without any children as opposed to having one child as indicated in the budget speech):

Moreover, as per the wording of the bill, the following married rates apply were each is the parent of two (2) or more children, and at least one (1) of such children was not over eighteen (18) years of age, or has not yet attained the age of twenty three (23) years if receiving full-time instruction at any university, college or other educational establishment (that is, the rates are applicable if the couple have 2 children (each) but it is sufficient for one of them to be under 18 (or 23 as applicable) years of age, which is contrary to what was indicated in the Budget Speech):

Moreover, the above reduced married tax rates apply only if both parents were resident in Malta for a period of not less than five (5) years and any one of the parents was a Maltese national or a national of a European Union or European Economic Area Member State.

Parent tax rates

The Budget Implementation Bill confirms the below tax rates for parents with one child:

However, the bill indicates that the following rates are available when an individual is the parent of two (2) or more children and at least one (1) of such children was not over eighteen (18) years of age, or has not yet attained the age of twenty three (23) years if receiving full-time education at any university, college or other educational establishment (in apparent conflict to what was indicated in the budget speech):

Moreover, the above reduced parent tax rates apply only if the parent, is resident in Malta for a period of not less than five (5) years; and was a Maltese national or a national of a European Union or European Economic Area Member State.

VAT Act

The proposed changes to the VAT Act are as follows:

The Bill empowers the Minister to exempt from VAT (potentially subject to conditions):

supplies made to;

intra-community acquisitions made by; and

importations made by,

diplomatic or consular arrangements or a person who qualifies for an exemption from tax in accordance with such international arrangements as the Minister may in accordance with such regulations prescribe.

Moreover, the bill proposes empowering the Minister to introduce regulations that prescribe for the refund (subject to conditions) by the Commissioner of the tax paid on supplies, intra-community acquisitions or importations by diplomatic or consular arrangements or by a person who qualifies for an exemption from tax in accordance with such international arrangements.

Changes to the provisions applicable to when a price is deemed to be inclusive of VAT (additions/changes in italics, our commentary in brackets and in red)

Where any person registered or required to be registered (so the provision also applies if the person was required to be registered but failed to register for VAT) indicates the price or consideration (including consideration in kind) payable for goods or services (previously this provision was restricted only to supplies of goods by retail) which shall be supplied to any other person (including a taxable person), such price or consideration (including consideration in kind) shall be deemed to be inclusive of VAT.

After the proposed change, the amount indicated shall be deemed to be exclusive of VAT only when:

the tax chargeable cannot be determined at the time the price or consideration payable for a supply is indicated; or

the supply is made to another person who is VAT registered and the Vat number is verified as valid, and it is specifically and unequivocally indicated that such price or consideration payable excludes VAT.

Deletion in its entirety of Article 83 of the VAT relating to prosecution.

Get in Touch:

Josef Mercieca

jmercieca@quazar.mt / +356 2388 4600